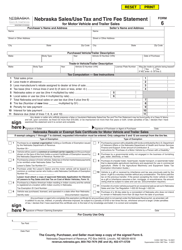

nebraska car sales tax form

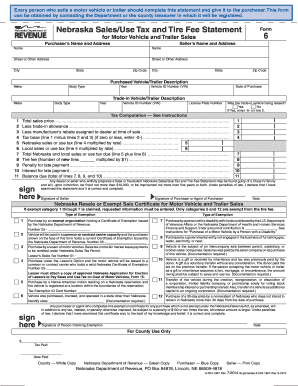

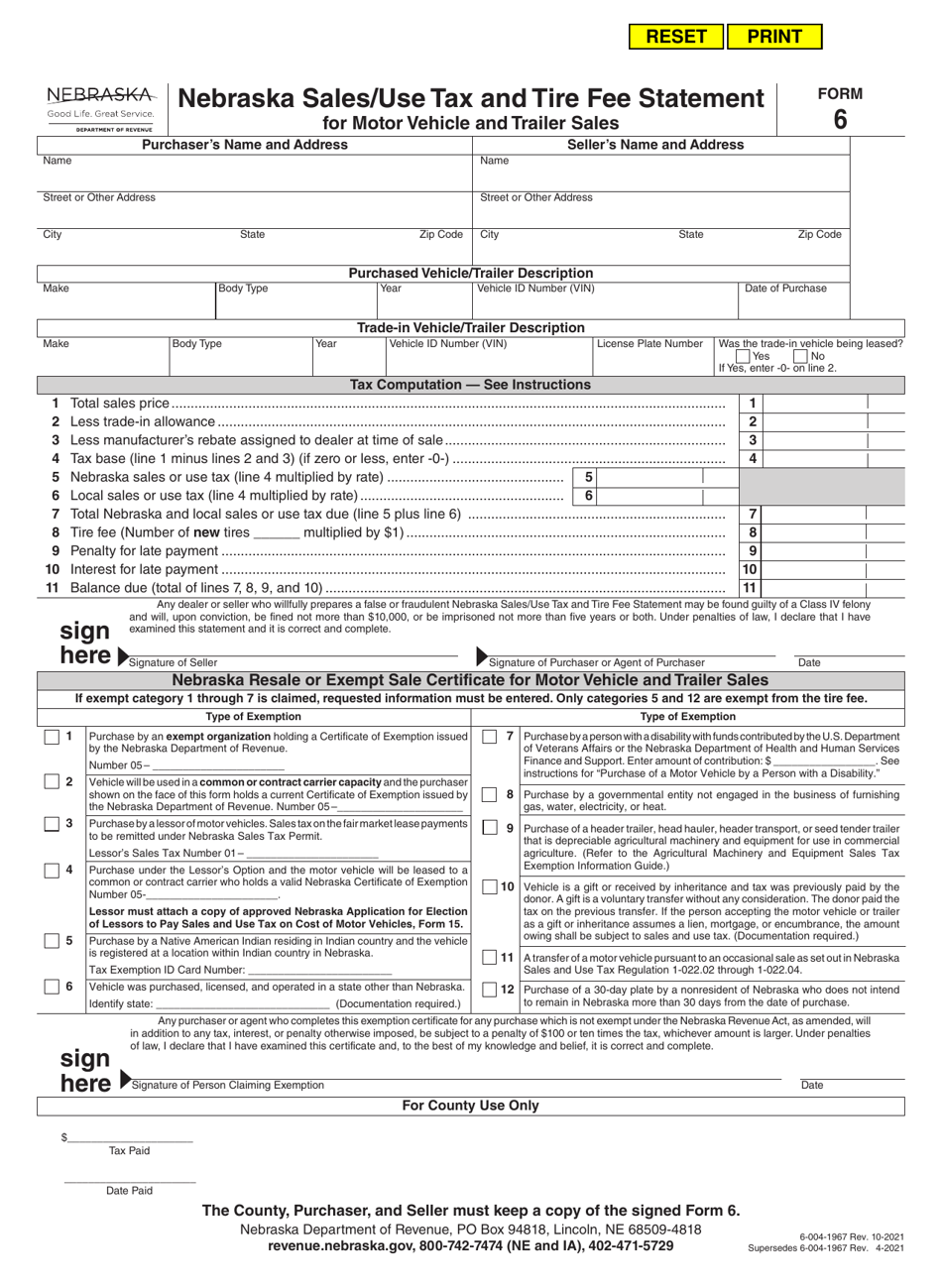

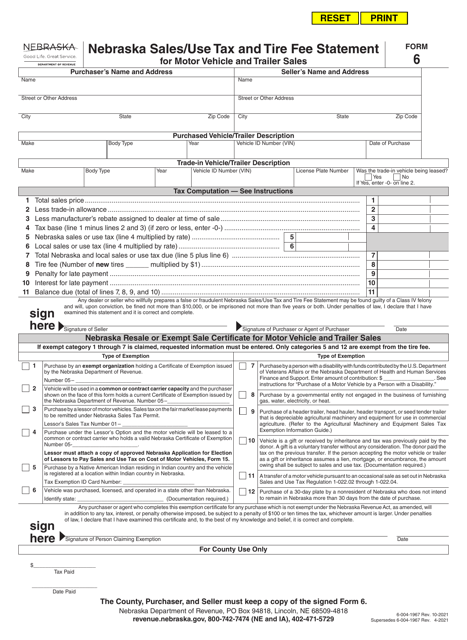

Sales and Use Tax Forms - Nebraska Department of. Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now.

Form 6 Nebraska Fillable Fill Out And Sign Printable Pdf Template Signnow

Nebraska sales and use tax form 10.

. In addition to taxes car. Prepare and file your sales tax with ease with a solution built just for you. Prepare and file your sales tax with ease with a solution built just for you.

Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now. Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

PURCHASERS NAME AND ADDRESS SELLERS NAME AND ADDRESS. All Major Categories Covered. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

Driver and Vehicle Records. The statewide sales tax for Nebraska is 55 for any new or used car purchases. Registration Fees and Taxes.

Nebraska SalesUse Tax and Tire Fee Statement. IRS 2290 Form for Heavy Highway Vehicle Use Tax. Nebraska vehicle sales tax form.

Ad Have you expanded beyond marketplace selling. Select Popular Legal Forms Packages of Any Category. To sign a Nebraska sales tax for motor vehicle and trailer sales form right from your iPhone or iPad just follow these brief guidelines.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Have you expanded beyond marketplace selling. Nebraska form 10 instructions.

For Motor Vehicle and Trailer Sales. With a sales tax rate of 55 in Nebraska this means you are paying an additional. It may take up to 75 calendar days for us to process your request.

Avalara can help your business. Avalara can help your business. Like all other goods retailers are required to charge a sales tax on the sales of all vehicles.

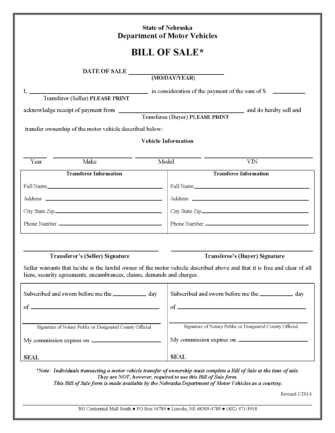

Nebraska vehicle title and registration resources. IRS Form W-9. Ad The Leading Online Publisher of National and State-specific Automobile Legal Documents.

Vehicle Title Registration. For vehicles that are being rented or leased see see taxation of leases and rentals. While some counties forgo additional costs most will charge a local tax on top of the state.

Fill Free Fillable Forms For The State Of Nebraska

Tax Form Templates 5 Free Examples Fill Customize Download

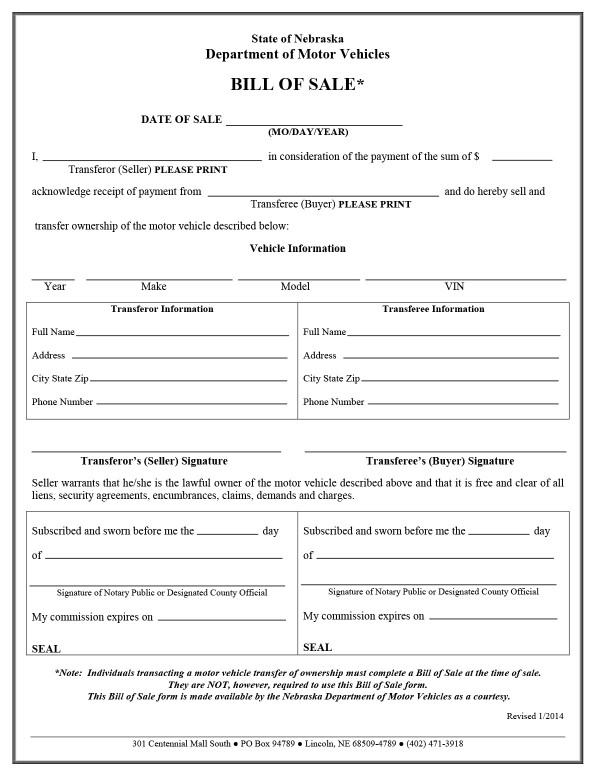

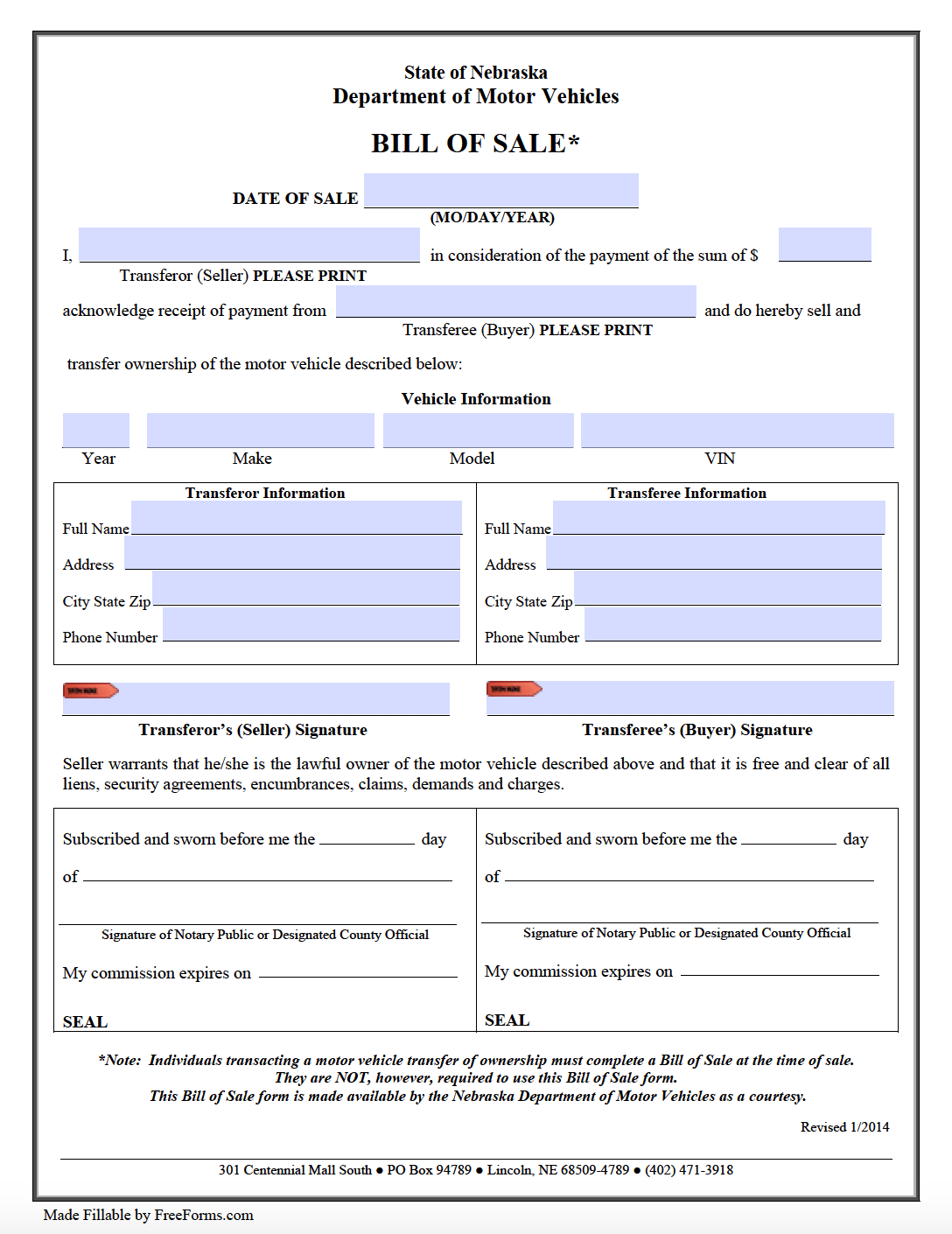

Bill Of Sale Nebraska Form Fill Out And Sign Printable Pdf Template Signnow

Nebraska And Local Sales And Use Tax Return Form 10 Pdf Fpdf Doc

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

All About Bills Of Sale In Nebraska The Forms And Facts You Need

3 11 3 Individual Income Tax Returns Internal Revenue Service

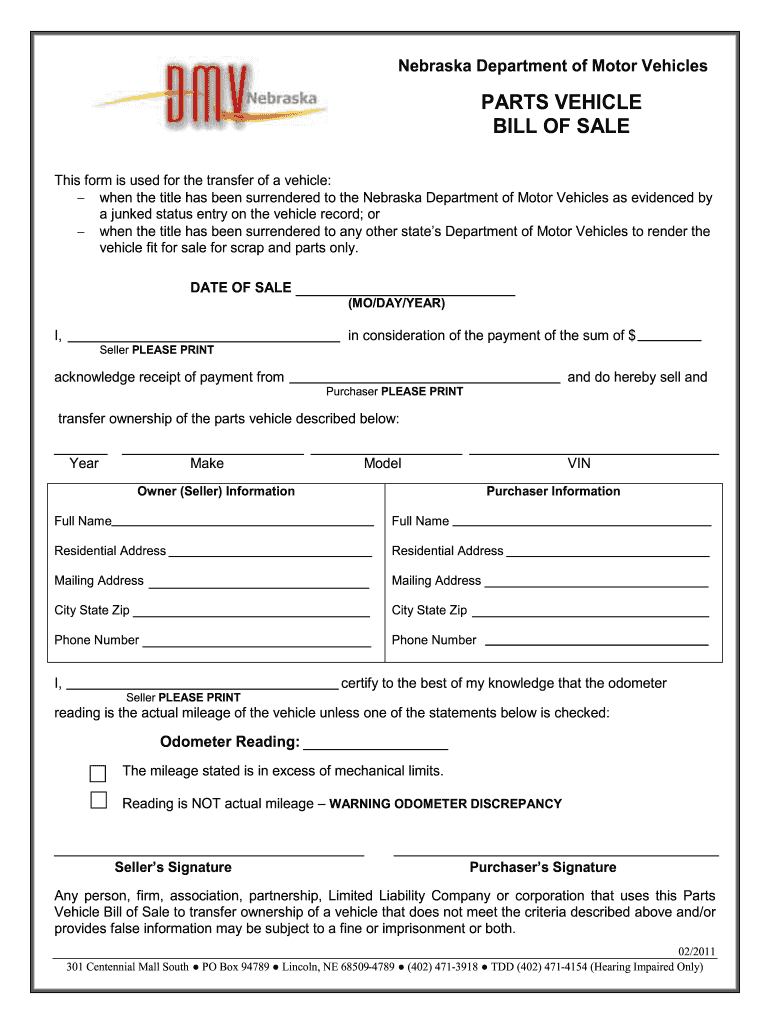

2011 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

2011 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Free Nebraska Motor Vehicle Dmv Bill Of Sale Form Pdf

Tax Form Templates 5 Free Examples Fill Customize Download

Form 6 Download Fillable Pdf Or Fill Online Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales Nebraska Templateroller

How To File Taxes For Free In 2022 Money

Ne Dor Form 6 2018 2022 Fill Out Tax Template Online Us Legal Forms