cap and trade versus carbon tax

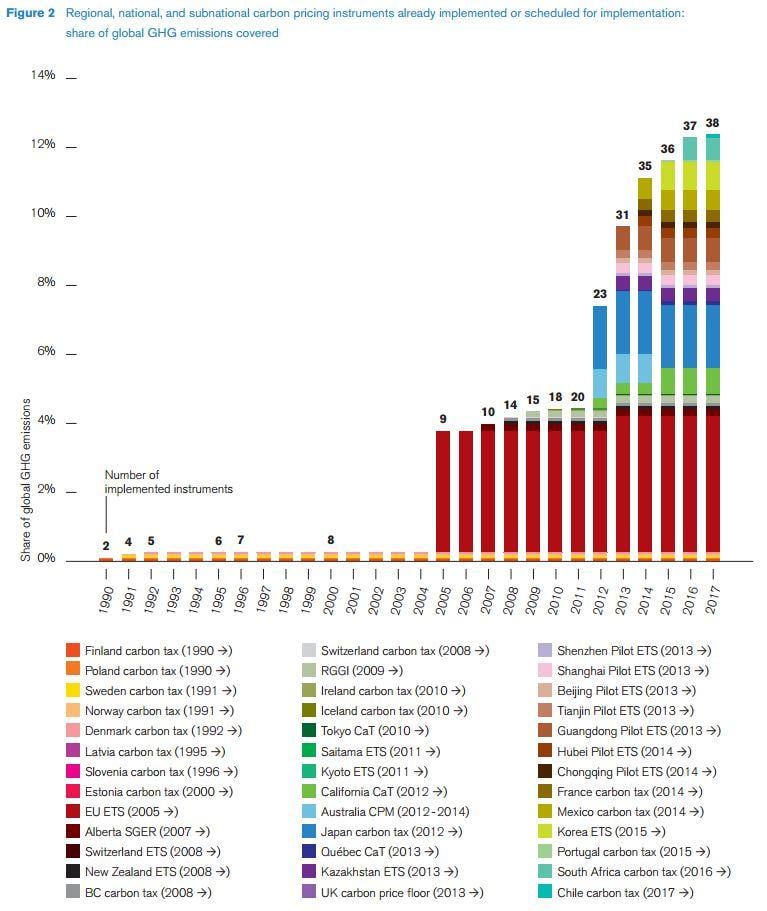

Cap and Trade have one environmental advantage over Carbon tax as it provides more certainty about the number of emission reductions that will lead to a little less certainty. Cap and Trade System vs.

Carbon Pricing 101 Union Of Concerned Scientists

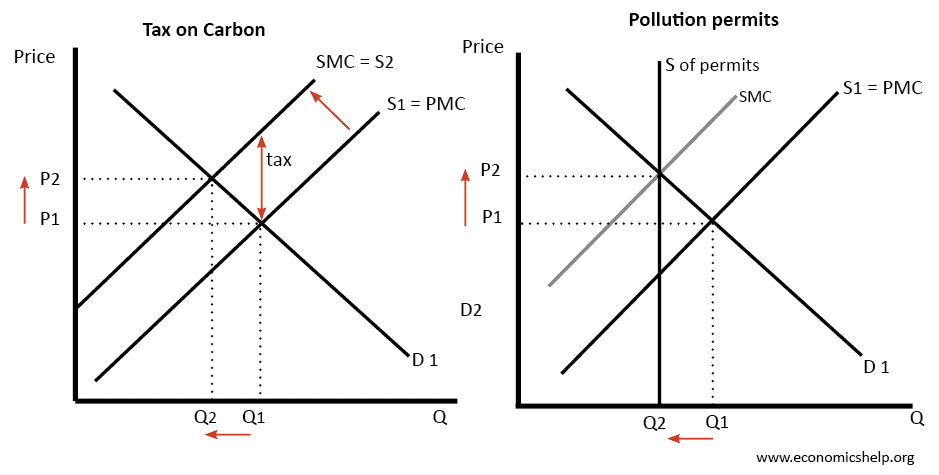

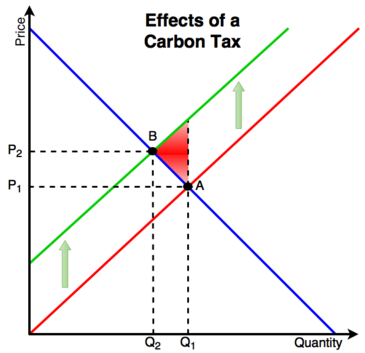

Carbon taxes and cap-and-trade are ways to price carbon but they both have some key differences.

. The most often cited benefits and drawbacks of each system can be surmised as follows. I find it really hard to believe but the perennial carbon tax vs. Cap-and-trade debate is still going on.

A 2016 paper in Energy Policy analyzed real-world carbon tax and cap-and-trade programs and found that policymakers earmark 70 of revenues from cap-and-trade to. It provides more certainty about the amount of emissions reductions that will result and little certainty about. Carbon Tax System - Research Paper Example The call for robust action on climate change is coherent and urgent.

It seems inevitable that some day Congress will pass legislation meant to cut greenhouse-gas. A carbon tax need not be introduced at such a high. With cap-and-trade units of carbon are initially given out for free.

-A Carbon Tax will provide greater efficiency and transparency than a Cap-and-Trade. April 9 2007 413 pm ET. It is obvious to.

As such they recommend applying the polluter pays principle and placing a price on carbon dioxide and other greenhouse gases. The two key strategies used to reduce carbon emissions are the carbon tax and the cap-and-trade strategy. Experts often debate the pros and cons of a carbon tax versus a cap-and-trade system in the United States and they will do so again at an event in Washington DC tomorrow.

Carbon Tax vs. A carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of. Theory and practice Robert N.

Cap-and-trade costs on the other hand will likely be passed through to end users with little chance of public remuneration. Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon. A key finding is that exogenous emissions pricing whether through a carbon tax or through the hybrid option has a number of attractions over pure cap and trade.

Carbon taxes vs. Cap-and-trade has one key environmental advantage over a carbon tax. This can be implemented either through.

In the first case governments charge a fee on companies and. It goes on and on and on and it never changes.

How Carbon Pricing Can Further Environmental Justice Recap

Laser Talk Bc Carbon Tax Vs Carbon Fee And Dividend Citizens Climate Lobby Canada

Difference Between Carbon Tax And Cap And Trade Youtube

Cap And Trade Vs Carbon Tax Power Sector Profits Versus Time For The Download Scientific Diagram

Pollution Permits Economics Help

Hooray For Carbon Taxes Mother Jones

Carbon Tax Vs Emissions Trading Energy Education

Econ 101 What You Need To Know About Carbon Taxes And Cap And Trade Macleans Ca

Pdf Economic Efficiency Of Carbon Tax Versus Carbon Cap And Trade Semantic Scholar

Carbon Policy Bc Carbon Tax Link To The World

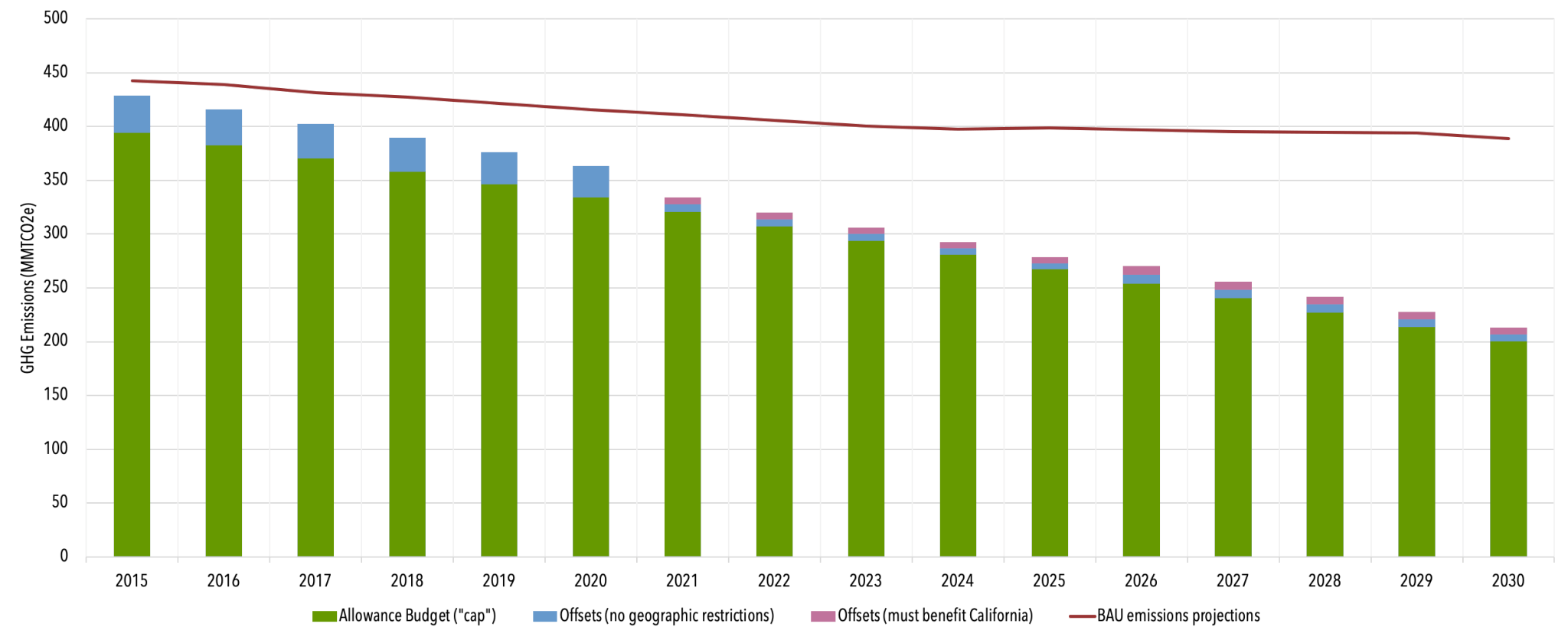

Cap And Trade Program Allowance Distribution Factsheet California Air Resources Board

Efficient Pricing Of Carbon In The Eu And Its Effect On Consumers Journalquest

California Cap And Trade Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

Carbon Tax And Revenue Recycling Details Analysis Tax Foundation

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Carbon Tax Carbon Pricing 15 Minute Guide Ecochain

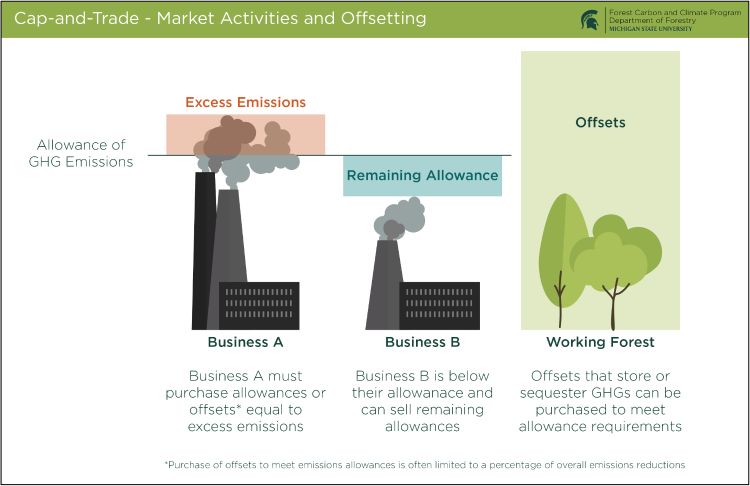

Carbon Pricing Carbon Markets And Carbon Taxes Forest Carbon And Climate Program

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia